Customer FAQs

- Home Loan

- Deposits

- Customer Communication

Frequently Asked Questions on Home Loans with HDFC Ltd

Existing HDFC Ltd. Home Loan customers (full/partial disbursement)

- Your Loan Account Number will remain the same and continue to be the point of reference for all your future communication with HDFC Bank Ltd.

- The contractual terms of your Loan agreement will remain unchanged.

You would continue to have access to HDFC Ltd Portal post-merger.

You can login to the Loan Portal or Mobile Application using your existing login credentials and password or via OTP mode.

The Merger will not impact your loan. There will be no impact on repayment cycle of the loan. EMI will be processed as per the loan repayment schedule. Further, there is no change in terms and conditions and the applicable Interest rate will also remain the same. Changes (If any) will be duly communicated.

Yes, the Loan Account will be transferred to HDFC Bank post the effective date of merger. Your customer login credentials will not change, and you can continue to access the portal and avail our services.

HDFC Bank Home Loan Customers who do not have either a Savings or Current Account with HDFC Bank can access their Home Loan details through the Home Loan section of the HDFC Bank website.

Home Loan account login credentials are different from Net Banking credentials.

- Existing HDFC Bank customers (having either a Savings or current account) can access home loan details through HDFC Bank’s Net Banking Portal.

- You can continue to access the HDFC Ltd portal even after the merger with your existing login credentials

You can request subsequent disbursements by logging into your account on our website or by emailing us at customer.service@hdfc.com. You can also visit the nearest HDFC Bank branch for Home Loans (erstwhile HDFC Ltd. branches) and submit the disbursement request in the prescribed format.

All prepayment inquiries will be handled at existing HDFC Bank branches for Home Loans (erstwhile HDFC Ltd. branches). You can also reach out to us via email at customer.service@hdfc.com or speak with one of our customer service representatives over the phone.

For detailed information on fees and charges, you can refer to the Fees & Charges section on our website. You can also check the copy of the loan application form or your loan agreement for these details.

The merger will not any have impact on your EMI; it will remain unchanged.

The applicable rate of interest to your account shall now be linked to EBLR (External Benchmark Lending Rate) instead of Retail Prime Lending Rate (RPLR). This is in compliance with the regulatory guidelines on floating rate of interest. On the day of the merger there will be no change in ROI and any changes in future will be based on EBLR.

The interest certificate can be downloaded from our website, customer login portal, writing to customer.service@hdfc.com or by visiting our nearest HDFC Bank Home Loan Servicing Branch.

You can download your interest certificate through any of the below given methods:

Login to your account on the customer login portal

Via WhatsApp,

Emailing us on customer.service@hdfc.com,

By visiting the nearest HDFC Bank branches for Home Loans (erstwhile HDFC Ltd. Branches)

There is no change in the process of loan ROI conversion, and you can avail the facility by visiting our HDFC Bank branches for Home Loans (erstwhile HDFC Ltd. Branches). You can also email us on customer.service@hdfc.com.

Or call us on our customer support numbers.

For applicable charges, please refer to our website.

As per existing process all servicing of Home Loans is already enabled thru our Customer Portal. So, you can continue to access the Customer Portal for any services related to your Home Loans even after the merger.

If you walk-in to any of our HDFC Bank Branch, our staff will help you to connect to the customer portal thru a link or a QR code. However, if your query or request is not resolved via the Customer Service Portal, our branch staff will help you formally log the query or request in the system. You will then receive due intimation about the time for resolution of the query or request. Post which your query or request will be serviced.

You can apply for a Top Up Loan after 12 months of the final disbursement of your existing Home Loan and upon possession / completion of the existing financed property. You can apply for a home loan either online on our website or by calling our helpline or by visiting the nearest HDFC Bank Home Loan Servicing Branch.

Customers with sanctioned, but undisbursed loans.

Please share the property and other disbursement related documents by raising a service request with your Home Loan Relationship Manager; or by sending an email on customer.service@hdfc.com. If you prefer, you can also drop the documents off at your closest HDFC Bank branches for Home Loans (erstwhile HDFC Ltd. branches).

You can avail the loan disbursement amount once the property has been technically appraised, all legal documentation has been completed and you have paid your own contribution in full.

You can choose from any one of the following methods to submit the request for disbursement:

Login to our website

Through your Relationship Manager

Mailing us on customer.service@hdfc.com.

Submit the disbursement request in prescribed format at the nearest HDFC Bank branch for Home Loans (erstwhile HDFC Ltd. branches).

Yes, for execution of your loan agreement and disbursement of related documents, you'll need to visit your nearest HDFC Bank branches for Home Loans (erstwhile HDFC Ltd. branches)

Customers with Loan application submitted / pre-sanction cases.

You can easily check your loan application's status through one of the below given ways:

Login to the customer portal on our website https://portal.hdfc.com/login.

call our toll-free helpline at 1800 210 0018 Or (STD code) 64807999,

email us at customer.service@hdfc.com,

visit the nearest HDFC Bank branches for Home Loans (erstwhile HDFC Ltd. branches)

Your Home Loan EMI amount can be calculated using our Home Loan EMI Calculator under the Checklist & Calculators Section on our website. Simply input the Loan Amount, Loan Tenure (In Years) and Interest Rate (% P.A.) to know the amount.

Frequently Asked Questions on Fixed Deposits with HDFC Ltd

Existing Fixed Deposit Holders

Your FD Account Number continues to be the same and will remain the reference point for all your future communications with HDFC Bank

The terms of your FD along with interest rates, interest computation methodology, tenure, maturity instructions and pay-outs will remain same until maturity/renewal of your FD

Your existing Deposit Receipt issued by HDFC Limited will continue to be valid till the maturity of the FD

Your existing HDFC Limited FD will also be covered by guarantee from DICGC, within an overall maximum limit of Rs 5 lacs (Principle & Interest) post-merger with HDFC Bank.

FDs held with HDFC Limited will continue to be shown and serviced through Customer Self Service Portal, and will not be available on HDFC Bank NetBanking/Mobile Banking.

New deposits booked through Customer Portal will also continue to be serviced through it.

If you are an existing customer of HDFC Bank with NetBanking or MobileBanking access:

Your HDFC Limited deposit booked before June 30 2023 will be visible in HDFC Limited Customer Portal only

HDFC Bank Fixed Deposits will be visible in HDFC Bank NetBanking & MobileBanking

Deposit booked through Customer Portal after June 30, 2023 will be visible in both HDFC Customer Portal & HDFC Bank NetBanking & MobileBanking

You will continue to have access to HDFC Limited Customer Portal, as you could before the merger

Yes, you will continue to be serviced by your existing Deposit Offices as it was before the merger. Moreover you can reach out to any of the 7500+ branches of HDFC Bank.

The Bank is committed to continue the arrangement with your associated Agent and they will be able to offer you services related to FDs

In addition, the Agents will now be able to offer you other banking products, like Savings Account, Current Accounts, Credit cards and an array of Loan products

New Booking/Renewal/Withdrawal of Fixed Deposits

- If the renewal date falls beyond the effective date of merger, renewal of FD will happen as per Bank’s terms and the Bank’s prevailing rates of interest at the time of renewal will apply. To know more of HDFC Bank’s current interest rates click here.

Individual customers can change the maturity instructions (renewal to repayment or vice versa) on FD with HDFC Limited through Customer Portal or by visiting existing Deposit offices of HDFC Limited or any other HDFC Bank branches

Non-Individual customers can change the Maturity Instructions (renewal to repayment or vice versa) on Fixed Deposit with HDFC Limited by submitting request at existing branch offices of HDFC or any HDFC Bank Branches

- Individuals can book deposit with HDFC Bank through the following channels

1. HDFC Limited Customer Portal or through KP App

2. HDFC Bank Branches including HDFC Deposit Offices

3. HDFC Bank NetBanking – in case they have an account with HDFC Bank

4. Any other digital platform of HDFC Bank

- You may reach out to Deposit Agent associated with your deposits or your assigned Relationship Manager with HDFC Bank

Non Individuals (Entities & Trusts): Physical Application at HDFC Bank Branches including HDFC Deposit Offices. You may reach out to Deposit Agent associated with your deposits or your assigned Relationship Manager with HDFC Bank

NRE/ FCNR Deposits: You can open New NRE/ FCNR Term deposit with HDFC Bank on Bank’s T&C. In order to open NRE/FCNR deposits online, you need to open a new NRE Savings/Current account. In case you already hold NRE Savings/Current account with HDFC Bank then you may login to NetBanking for placing a request for NRE/FCNR Term deposit opening.

- In case you wish to open NRE Savings/Current Account but are unable to visit the branch you can fill in our NRI lead application form (Click Here) and our account opening team will assist, alternatively, in case you are able to visit any of our branches then you can submit physical application for opening NRE/ FCNR Term deposits and NRE Savings/Current Account.

NRO Deposits: You can open New NRO Term deposit with HDFC Bank on Bank’s T&C. In order to open NRO deposits online, you need to open a new NRO Savings/Current account. In case you already hold NRO Savings/Current account with HDFC Bank then you can login to NetBanking for placing a request for NRE/FCNR Term deposit opening. In case you wish to open NRO Savings/Current Account but are unable to visit the branch you can fill in our NRI lead application form and our account opening team will assist you, alternatively, in case you can visit any of our branches then you can submit physical application for opening NRO Term deposits and NRO Savings/Current Account.

- Please Note : The new deposit placements may require you to complete requirements with regard to ‘Know Your Customer’ guidelines. Kindly visit your HDFC Bank Branch including erstwhile HDFC Limited deposit centre to complete the KYC process. Alternatively, you may click Here to do it online.

- NRI depositors need to submit physical request to update RE KYC on bank records or in case they wish to make any changes to details like address, contact details, DOB up dation etc updated on erstwhile HDFCL NRO Deposit accounts. The forms and documents required would be as per existing process of HDFC Bank applicable for NRI Customers.

- NRI RE KYC updation request can be submitted at the nearest branch by visiting the bank branch in person with all original KYC documents. In case you are unable to visit the branch and wish to submit the request under non face to face basis then along with RE KYC form you need to submit certified copies of KYC documents and KYC documents needs to be certified by designated authorities

- Please click Here to get various application forms for resident and Non-resident customers.

Premature Withdrawal

Pre-Mature withdrawal of FD : Premature liquidation of erstwhile HDFC Limited deposit will be done as per premature withdrawal terms & conditions applicable on HDFC Limited deposit. You can continue to do it through Branches, Agents or Customer Portal like before.

Recurring Deposits

Your existing recurring deposit will continue and monthly instalment will be debited from the linked account as updated against the RD as per the mandate submitted.

To open new RD, we request you to open a Savings Account with HDFC Bank through which you can book an RD.

TDS/PAN Card/Form 15G

The existing threshold limit for TDS deduction is Rs 5,000 for the customers of the HDFC Limited. After merger threshold limit of Rs 5,000 will change to Rs 40,000 (Rs 50,000 for senior citizens) for all the existing customers of HDFC Limited.

Interest paid/ reinvested/ accrued by both HDFC Bank and HDFC Limited for the full financial year will be added for arriving at the threshold of Rs 40,000 (Rs 50,000 for senior citizens)

TDS will be deducted when the actual interest paid/accrued/reinvested exceeds the threshold limit of Rs 40,000 (Rs 50,000 for senior citizens) as against the earlier methodology of deducting basis projected interest exceeding the threshold of Rs 5,000.

Example: Assuming the interest paid to a customer is Rs 22,000 for deposits with HDFC Limited and the same customer is paid interest of Rs 20,000 by HDFC Bank. As the combined interest is Rs 42,000, TDS will be deducted on the aggregated interest.

The threshold limit of TDS deduction for HDFC Limited customers will change from Rs 5,000 to Rs 40,000/- (Rs 50,000/- for senior citizens). If any TDS is already deducted before merger by HDFC Ltd basis earlier threshold of Rs 5,000, it will be adjusted towards future TDS obligation for the Financial Year. However, if such adjustment cannot happen as there is no future TDS obligation, then the customer will have to claim credit while filing his tax returns basis the TDS certificate issued. HDFC Bank cannot make refund of TDS rightly deducted by HDFC Ltd in the pre-merger period.

| Period | Paid/Accrued | Amount Paid- HDFC Limited | Amount Paid- HDFC Bank Limited | Cumulative Total | TDS | Remarks |

|---|---|---|---|---|---|---|

Jun-23 |

Paid |

7,000 |

3,750 |

10,750 |

700 |

TDS deducted by HDFC Limited basis earlier threshold of Rs 5,000 |

| June-30: Merger of HDFC Limited with HDFC Bank | ||||||

Sep-23 |

Paid |

7,000 |

3,750 |

21,500 |

- |

No TDS as combined interest paid is less than the new threshold of Rs 40,000 after merger. |

Dec-23 |

Paid |

7,000 |

3,750 |

32,250 |

- |

No TDS as combined interest paid is less than Rs 40K |

Mar-24 |

Paid |

7,000 |

3,750 |

43,000 |

3,600 |

TDS @10% to be deducted as threshold of Rs 40,000 exceeded. Net TDS of Rs 3600 deducted after adjusting for Rs 700 deducted earlier ( Rs 4300-Rs 700) |

|

Total |

28,000 |

15,000 |

43,000 |

4,300 |

|

In the initial Year of Merger (FY 23), TDS return will be filed under two TANs (of HDFC Limited and HDFC Bank), there will be two TDS certificates for common customers (customers having Term deposits both with HDFC Limited and with HDFC Bank). The existing process of despatch TDS certificates will be used by HDFC Limited and HDFC Bank respectively.

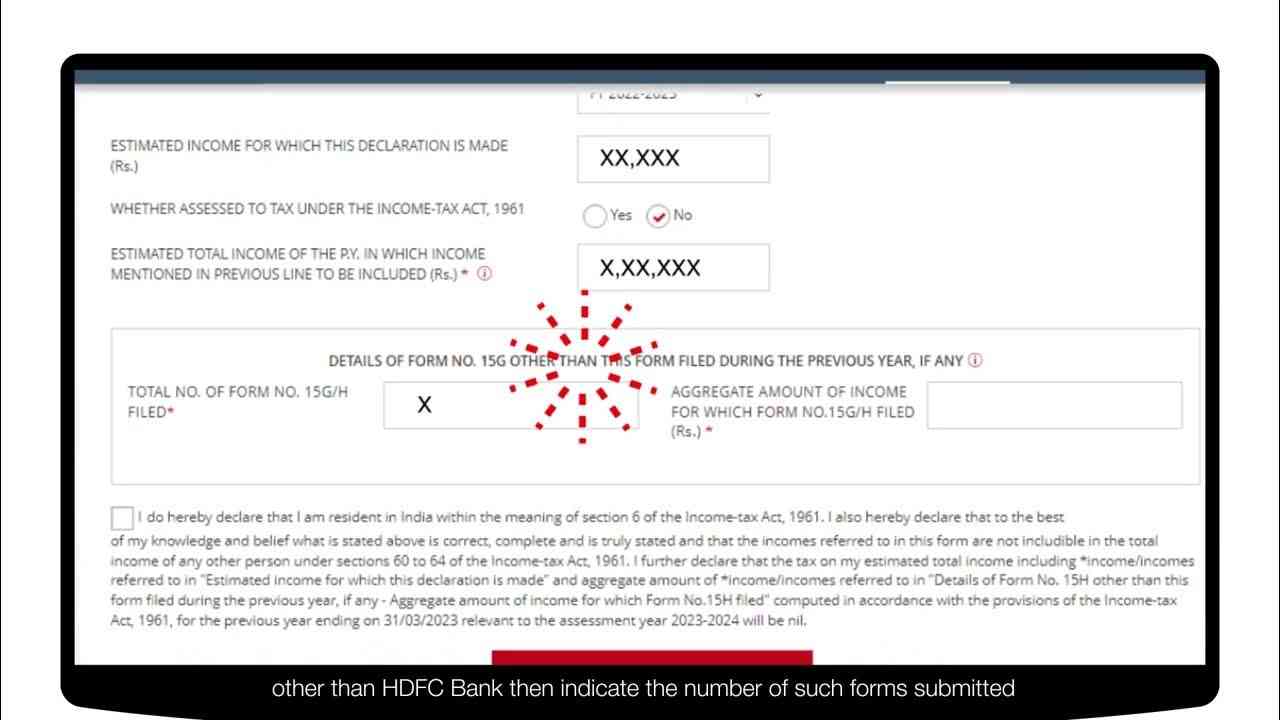

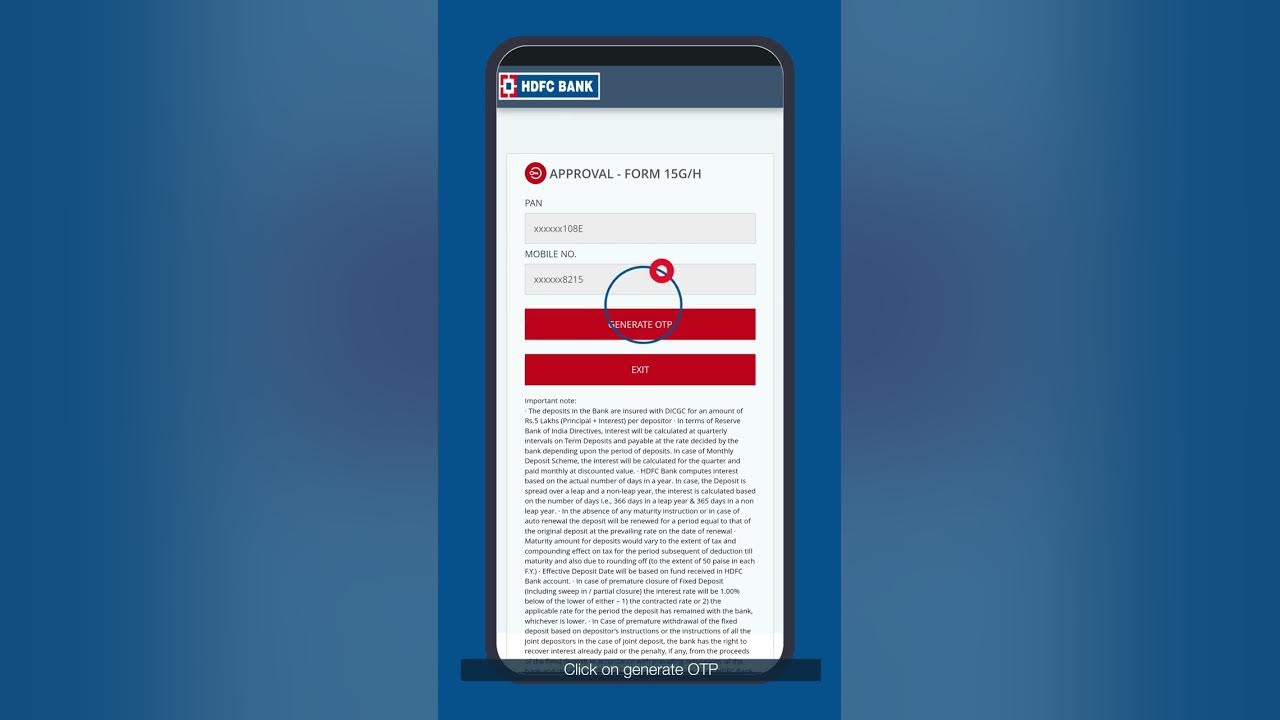

Form 15 G / H submitted by customers of HDFC Limited for FDs placed with HDFC Limited before merger will be valid.

However, If a customer places any fresh FD post-merger, he will need to submit additional Form G/H for the new FD. Existing customers of HDFC Ltd can continue to use the current process / platform for submitting Form 15 G/H for FD booked in post-merger period.

If Form 15 G/H was submitted with HDFC Limited prior to merger and such FD is renewed after merger. Such renewal of FD will happen with HDFC Bank, and a fresh 15 G/H will be required to be submitted by customer.

NRI Customers can submit DTAA request at HDFC Bank to avail concession TDS on NRO Deposits.

Customers will be required to submit the Form 15 G /H at FD level and not PAN level.

One single Form G/H can contain the details of all the existing FDs booked till that date.

Example: On 30th September 2023 - Two new FD were booked and one FD was renewed for a customer, Customer can submit one Form 15 G / H for all these three FD on or after 30th September 2023.

Yes, Form G/H will need to be submitted separately. Existing customers of HDFC Limited and Bank can continue to use the respective existing process / platform for submitting Form 15 G/H for FD booked in post-merger period.

NRI Customers can submit DTAA request at HDFC Bank to avail concession TDS on NRO Deposit separately.

The amount of interest paid/accrued during the year has exceeded the threshold limit of Rs. 300,000/- (Form15G) or Rs 700,000/- (Form 15H). When the total interest paid by HDFC Limited & HDFC Bank crosses the threshold limit mentioned herein, Form 15G/H becomes invalid and TDS is deductible on entire interest paid.

Further if Form 15 G/H was submitted during the period between 1st April 2023 to 30th June 2023 and if the PAN becomes inoperative (for PAN not having linked Aadhar) on 1st July 2023 than the Form 15 G/H submitted becomes invalid and TDS will be deductible as applicable.

All the customers of HDFC Limited who have given lower or nil tax exemption certificates/DTAA documents during the year before effective date of merger will be considered good and valid through the Financial Year.

Further customers can continue to provide the Lower or nil tax exemption certificates / DTAA documents as per the extant process in the Financial Year 2023-24 even after merger.

As the TDS return will be filed under two TANs (of HDFC Limited and HDFC Bank) in the initial year of merger, there will be two TDS certificates for common customers for HDFC Limited & HDFC Bank. The existing process of despatch of TDS certificates will be used by HDFC Limited & HDFC Bank respectively.

All Individual customers having PAN (where the 4th character of PAN is ‘P’) are required to link PAN and Aadhaar.

If PAN is not linked with Aadhaar, such PAN will become inoperative w.e.f. 1st July 2023 and customer will not be allowed to submit Form 15 G/H and higher TDS deduction will be applicable for inoperative PANs.