INTRODUCTION

It has been over two years since the World Health As at March 31, 2022, as per WHO, globally there were 475 million cumulative confirmed cases of COVID-19 and over 6.1 million fatalities.

Though much progress has been made in terms of vaccinations and adapting to co-existing with the virus, it is evident that new variants of the virus will continue to emerge. While the severity of the virus strains appears to have lessened, the risk of recurring waves of infections cannot be undermined.

At the beginning of the financial year under review, the global economy started showing signs of economic recovery. Yet, across countries, there remained divergence in the pace of recovery, largely differentiated by the extent of vaccine access.

By mid FY22, inflation started to rise across most countries. Major global central banks initially deemed rising inflation as transitory, largely attributing it to temporary supply chain disruptions. Global markets remained awash with liquidity, inflating most asset classes.

For most of FY22, major central banks continued with their accommodative monetary policy stance in order to support growth. In addition, governments and financial regulators provided a slew of measures to alleviate the impact of the pandemic and cushion the shock to various sectors of the economy.

By November 2021, the Federal Reserve clearly articulated concerns of rising inflation and its willingness to tighten policy rates. In March 2022, the Federal Open Market Committee raised the federal fund rates by 25 basis points ² its first rate hike since 2018.

The last quarter of the financial year under review saw increased volatility in global markets owing to an outbreak of the Omicron variant, economic slowdown in China, faster than anticipated pace of monetary tightening across advanced economies and the eruption of geopolitical tensions. Consequently, oil and other commodity prices touched multi-year highs. Owing to increased risk averseness setting in, most emerging markets saw massive sell-offs.

India Overview

In India, in the second half of FY21, the rebound from the COVID-19 induced slump was sharper than anticipated. The economic momentum, however, was disrupted once again in the first quarter of FY22, owing to a second wave of COVID-19. This wave entailed severe consequences such as spiralling infections, shortages of essential medical supplies and an increased death toll. According to the Reserve Bank of India (RBI), the loss of output as a result of the second wave was 40% lesser than the first wave. This was because unlike in the first wave of the pandemic which entailed a strict national lockdown, during the second wave, the strategy of microcontainment ]ones was adopted, with various state governments and local authorities imposing lockdowns or restrictions of varying degrees. Thus, economic activity was less hindered, barring contact intensive sectors. The key differentiator was that the first wave in India was characterised by loss of livelihoods, while the second wave entailed a higher loss of lives.

Towards the end of June 2021, there was an ebbing of the second wave. This coupled with the easing of pandemic related restrictions, increased vaccination coverage, strong agriculture growth supporting rural demand and the unleashing of pent up urban demand augured well for the Indian economy.

In the fourth quarter of FY22, India once again experienced a surge in infections, with significantly higher transmissibility, but of lesser severity. This wave receded quickly with a lesser impact on overall economic activity.

Throughout the year, the RBI accorded priority to growth and retained an accommodative monetary policy stance. The RBI managed liquidity in the system through a combination of the Government Securities Acquisition Programme, open market operations, Operation Twist, sell/buy swaps and long duration variable rate reverse repo operations.

As per the second advance estimate by the National Statistical Organisation (NSO), the Indian economy is expected to grow 8.9% in FY22 compared to a contraction of 6.6% in FY21. Most high frequency indicators exhibited good recovery, surpassing pre-pandemic levels. India’s tax collections in FY22 stood at an all-time high of ` 27.07 lac crore, reflecting better tax compliance and better revenues in direct and indirect taxes.

In March 2022, India’s retail inflation spiked to 6.95%, which marked the third consecutive month of inflation being above the RBI’s tolerance threshold of 6%. Core inflation, which excludes food and oil prices, was also above 6%. Higher inflationary expectations resulted in bond yields moving upwards.

On the external front, while India’s exports touched an all-time high of US$ 418 billion, the sharp increase in international commodity prices, coupled with domestic demand recovery resulted in a rebound in imports, which in turn widened the trade and current account deficits. India’s foreign exchange reserves stood at a comfortable US$ 606 billion as at end of March 2022.

In FY22, domestic institutional investor net inflows stood at US$ 26.8 billion compared to foreign portfolio investors who were net sellers to the tune of US$ 16.0 billion.

Housing and Real Estate Markets

The residential real estate market continued to see strong growth in housing sales and new launches. Overall inventory levels have decreased. Factors such as low interest rates, rising income levels, stable property prices, improved affordability and continued support of fiscal incentives for home loans are some of the reasons for strong demand for home loans.

The housing market continued to witness a trend of increased number of first-time homebuyers and those moving up the property ladder by opting for larger homes or acquiring homes in another location. The need for housing was also triggered by a larger number of people working from home.

Given the low mortgage to GDP penetration at 11% in India and the continued shortage of housing, the scope to grow the mortgage market in India remains immense.

There was increased demand in the commercial real estate sector as well. There was strong demand for office space across the major metro cities, with demand largely stemming from IT, e-commerce and the professional services sectors.

Demand for commercial real estate increased from data centres, which play a key role in supporting the digital economy. Data centres were accorded infrastructure status in the Union Budget 2022. The demand for warehousing and fulfilment centres too increased, led by the continued boom in e-commerce and logistics.

MATERIAL DEVELOPMENTS

Proposed Transformational combination of HDFC Limited with HDFC Bank Limited

On April 4, 2022, the Board of Directors of HDFC (the Corporation) and HDFC Bank Limited (HDFC Bank) at their respective meetings, inter alia, approved a composite scheme of amalgamation (Scheme) for the amalgamation of (i) the Corporation’s whollly-owned subsidiaries, HDFC Investments Limited and HDFC Holdings Limited, with and into the Corporation; and (ii) The Corporation with and into HDFC Bank, under Sections 230 to 232 of the Companies Act, 2013 and other applicable laws, including the rules and regulations, subject to requisite approvals from various regulatory and statutory authorities, respective shareholders and creditors.

Upon the Scheme becoming effective, the subsidiaries/associates of the Corporation will become subsidiaries/associates of HDFC Bank. Shareholders of the Corporation as on the record date will receive 42 shares of HDFC Bank (each of face value of ₹ 1), for 25 shares held in the Corporation (each of face value of ₹ 2), and the equity shares held by the Corporation in HDFC Bank will be extinguished as per the Scheme. 8pon the Scheme becoming effective, HDFC Bank will be 100% owned by public shareholders and existing shareholders of the Corporation will own 41% of HDFC Bank.

Rationale of the Scheme

The rationale and benefits of the Scheme are as follows:

Thus, the amalgamation would be in the best interest of the shareholders of the Corporation and HDFC Bank and shall not in any manner be prejudicial to the interests of the concerned shareholders or the creditors or general public at large.

The coming into effect of the Scheme i.e. the Effective Date shall occur only after all requisite consent, approvals and permissions are obtained by both, the Corporation and HDFC Bank.

As per the proposed Scheme, on the Effective Date, all outstanding liabilities, contingent liabilities, debts, loans (outstanding liabilities) of the Corporation shall be transferred to HDFC Bank on the same terms and conditions as were applicable to the Corporation. Accordingly, HDFC Bank shall meet, discharge and satisfy its duties and obligations pertaining to the transfer and vesting of all outstanding liabilities of the Corporation on the Effective Date and it shall not be necessary to obtain any further consent of any third party or other person who is a party to any contract or arrangement by virtue of which such liabilities have arisen.

Till the Effective Date, the Corporation, as an independent entity shall carry on business in the ordinary course as a Non-Banking Financial Company – Housing Finance Company (NBFC-HFC).

KEY REGULATORY CHANGES

In an endeavour to harmonise regulations between NBFCs and banks, the RBI has issued various regulations applicable for NBFC-HFCs. Some of these regulations are:

Principal Business Criteria: To qualify as a NBFC-HFC, of the total assets (netted off by intangible assets), not less than 60% should be towards providing finance for housing. Further, out of the total assets (netted off by intangible assets), not less than 50% should be by way of housing financing for individuals

The transition timeline for compliance is as under:

| Timeline | Minimum percentage of total assets towards housing finance | Minimum percentage of total assets towards housing finance for individuals |

|---|---|---|

| March 31, 2022 | 50% | 40% |

| March 31, 2023 | 55% | 45% |

| March 31, 2024 | 60% | 50% |

As at March 31, 2022, 59.2% of the Corporation’s total assets were towards housing finance and 54.7% of total assets were towards housing finance for individuals.

Liquidity Coverage Ratio: NBFC-HFCs are required to maintain liquidity buffers to withstand potential liquidity disruptions by ensuring that it has sufficient High 4uality Liquid Assets (HQLA) to survive any acute liquidity stress scenario lasting for 30 days on a daily basis. As per the guidelines, the weighted values are calculated after the application of respective haircuts for HQLA and after considering stress factors on inflows at 75% and outflows at 115%.

For all deposit taking NBFC-HFCs, there is a phased transition towards meeting the minimum LCR as given below:

| Timeline | December 01, 2021 | December 01, 2022 | December 01, 2023 | December 01, 2024 | December 01, 2025 |

|---|---|---|---|---|---|

| Minimum LCR | 50% | 60% | 70% | 85% | 100% |

Accordingly, the Corporation is required to carry higher levels of liquidity, largely in government securities. The Corporation’s liquidity coverage ratio as at March 31, 2022 was 80% as against a minimum requirement of 50%.

Non-performing Assets (NPA): On November 12, 2021, RBI issued a notification on Prudential Norms on Income Recognition, Asset Classification and Provisioning (IRACP) pertaining to Advances ² Clarification, with the obMective of harmonising regulatory guidelines for all lending institutions. RBI stipulated that borrower accounts be flagged as overdue as part of their day-end process for the due date. RBI also stipulated that NPA accounts can only be upgraded to standard provided all outstanding dues have been fully repaid. In February 2022, RBI provided time till September 30, 2022 for NBFCs to comply with the upgradation criteria.

The Corporation, however, has not opted for the deferment. Accordingly, the classification of assets and provisioning is in accordance with the November 12, 2021 notification. Further details are elucidated in the section on Asset Quality in the report.

Risk Based Internal Audit (RBIA): The RBI has stipulated that all deposit taking HFCs are mandated to have a RBIA framework in place by June 30, 2022. The objective is to have an audit methodology that links an organisation’s overall risk management framework and provides an assurance to the board and senior management on the quality and effectiveness of the organisation’s internal controls, risk management and governance related systems and processes.

Scale Based Regulations: RBI’s notification specified that Scale Based Regulations would be introduced with effect from October 2022. Under these regulations, the Corporation may be categorised as a NBFC Upper Layer (NBFC-8L), largely based on its asset size. Final intimation from RBI on the same is still awaited.

Scale based regulations entail further alignment of regulations of NBFCs with those applicable to banks on internal capital adequacy assessment process, concentration of credit/investment, large exposure framework, role of the chief compliance officer, senior management compensation and adoption of core financial services solution, amongst others. Various timelines have been stipulated for compliance with the same.

IMPACT OF COVID-19

FINANCIAL AND OPERATIONAL PERFORMANCE IN FY22

Highlights of the Financial Performance

Total income of the Corporation for the year ended March 31, 2022 was ₹ 47,990 crore compared to ₹ 48,176 crore in the previous year. Total expenses stood at

₹ 30,744 crore compared to ₹ 33,361 crore in the previous year.

The net interest income (NII) for the year ended March 31, 2022 stood at ₹ 17,119 crore compared to ₹ 14,970 crore in the previous year, representing a growth of 14%.

For the year ended March 31, 2022, dividend income stood at ₹ 1,511 crore compared to ₹ 734 crore in the previous year. The increase in the dividend income was predominantly due the dividend received from HDFC Bank. In the previous year, owing to risks of the pandemic, the regulator did not permit banks to declare dividends.

The profit on sale of investments during the year was ₹ 263 crore as compared to ₹ 1,398 crore in the previous year.

The provisioning for Expected Credit Loss (ECL) during the year was lower at ₹ 1,932 crore as compared to ₹ 2,948 crore in the previous year, reflecting improved asset quality.

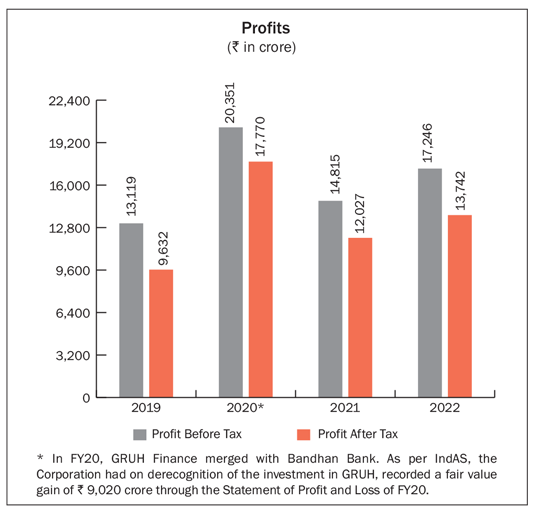

The reported profit before tax for the year ended March 31, 2022 stood at ₹ 17,246 crore compared to ₹ 14,815 crore in the previous year, representing a growth of 16%.

After providing for tax of ` 3,504 crore (previous year: ` 2,788 crore), the profit after tax for the year ended March 31, 2022 stood at ` 13,742 crore compared to

` 12,027 crore in the previous year, recording a growth of 14%.

The total comprehensive income for the year ended March 31, 2022 stood at ` 13,776 crore compared to ` 13,762 crore in the previous year.

Statement of Profit and Loss

Key elements of the statement of profit and loss for the year ended March 31, 2022 are:

These items aggregate to ` 22,300 crore. Hence, Tier I Capital stood at ` 97,951 crore as against the reported net worth of ` 1,20,251 crore.

Based on the above, as at March 31, 2022 the return on Tier I Capital is 15.0%.

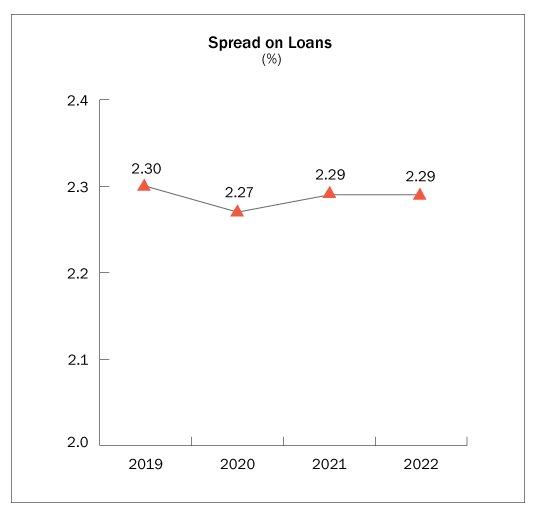

Spread on Loans

The average yield on loan assets during the year was 8.06% p.a. compared to 8.99% p.a. in the previous year. The average all-inclusive cost of funds was 5.77% p.a. as compared to 6.70% p.a. in the previous year. The spread on loans over the cost of borrowings for the year was 2.29% p.a., the same as in the previous year. Spread on individual loans for the year was 1.93% and on nonindividual loans was 3.40%.

Operational Performance

Lending Operations

Despite the challenges posed by recurring waves of COVID-19 infections during the year, lending operations of the Corporation continued seamlessly. Much of this was attributed to the ability to stay connected with customers by leveraging on the Corporation’s digital platforms. The demand for housing continued to be strong for both, the affordable housing and high end segments.

During the year, individual approvals and disbursements grew by 38 and 37% respectively

The average size of individual loans stood at ` 33 lac during the year, compared to ` 29.5 lac in the previous year. The increase in the average loan size is reflective of an increased proportion of loans in value terms to high income groups compared to the previous year.

Based on loans disbursed during the year, 78% were salaried customers, while 22% were self-employed (including professionals). In terms of the acquisition mode, of the loans disbursed during the year, 55% were first-purchase homes i.e. directly from the builder, 37% were through resale and 8% self-construction.

As at March 31, 2022, cumulatively, the Corporation had financed 9.3 million housing units.

Affordable Housing

The Ministry of Housing and Urban Poverty Alleviation (MoHUPA) had launched the Credit Linked Subsidy Scheme (CLSS) in June 2015 under the Pradhan Mantri Awas Yojana (PMAY- Urban) – Housing for All. The original scheme covered Middle Income Groups (MIG), Low Income Groups (LIG) and Economically Weaker Section (EWS). The scheme’s validity was till March 31, 2022.

The Corporation has the largest number of home loan customers – of approximately 3.14 lac who have availed benefits under the Credit Linked Subsidy Scheme (CLSS). As at March 31, 2022, cumulative loans disbursed by the Corporation under CLSS stood at ` 52,144 crore and the cumulative subsidy amount stood at ` 7,228 crore.

The Corporation remains committed to continuing to support affordable housing initiatives.

Housing Loan Approvals to Customers Based on Income Slabs in FY22

| Category | Household Income per annum |

Home Loan Approvals in FY22

|

|

|---|---|---|---|

| % in Value Terms | % in Number Terms | ||

| Economically Weaker Section (EWS) & Low Income Group (LIG) | EWS: 8p to ` 3 lac LIG: Above ` 3 lac up to ` 6 lac | 13 | 29 |

| Middle Income Group | Above ` 6 lac

up to ` 18 lac |

42 | 48 |

| High Income Group | Above ` 18 lac | 45 | 23 |

| Total | 100 | 100 | |

The average home loan to the EWS and LIG segment during the year stood at ` 11.2 lac and ` 19.7 lac respectively.

Rural Housing

Against the backdrop of a good monsoon and strong agricultural growth, the rural economy remained resilient. India’s foodgrain production is estimated to touch a record high of 316 million tonnes for the crop year 2021-22 and agricultural exports too stood at an all-time high of US$ 50 billion in FY22.

The Corporation continued its focus on rural housing, providing loans to both, salaried and self-employed customers for properties situated in rural areas. Most of these customers have household incomes from agriculture and agri-allied industries. The properties under rural housing are located either in the hinterland or in peripheral areas closer to larger cities. Rural housing loans accounted for approximately 8% of outstanding individual loans.

The Corporation has a rural home loan mobile application to capture information on crop cultivation, geo-coordinates of the farm land, soil conditions, irrigation facilities, amongst others. The information captured during field visits flows on a real time basis directly to the appraisal hub, thereby enabling faster and efficient loan processing. In addition, under the Digital India initiative of the government, land records in many states have been digitalised, thereby facilitating increased rural lending.

Non-Individual Loans

During the year, there was gradual pick-up in growth in the non-individual loan portfolio, particularly for lease rental discounting and construction finance.

The Indian real estate sector is on an upcycle. Increased demand for homes, lower inventory levels and a strong pipeline of new project launches augurs well for the sector.

In the case of lease rental discounting, loans are disbursed against ready projects with tenants in place and hence the turnaround time between approval and disbursement is relatively short.

Disbursement for construction finance, however, is based on progress of construction and hence has a longer lead time between approval and full disbursement of the facility. The Corporation continued to remain selective in incremental lending for construction finance.

Loan Portfolio

The loan approval process of the Corporation is decentralised, with varying approval limits. The Corporation has a three-tiered committee of management structure with varying approval limits. Larger proposals are referred to the Board of Directors.

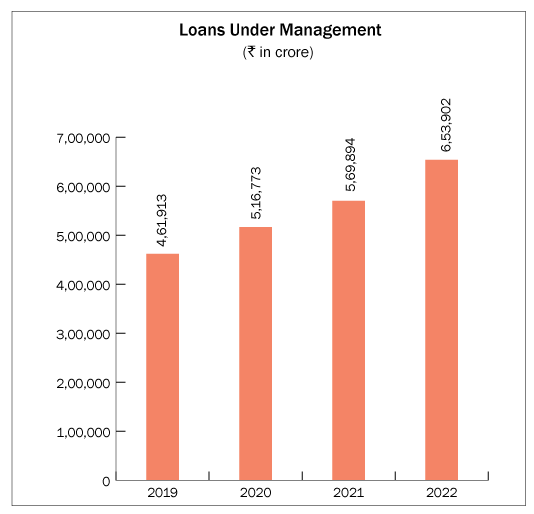

The Assets Under Management (AUM) as at March 31, 2022 amounted to ` 6,53,902 crore as compared to ` 5,69,894 crore in the previous year.

On an AUM basis, the growth in the individual loan book was 17%. The growth in the total loan book on an AUM basis was 15%.

During the year, the Corporation’s loan book increased from ` 4,98,298 crore to ` 5,68,363 crore as at March 31, 2022. In addition, total loans securitised and/or assigned by the Corporation and outstanding as at March 31, 2022 amounted to ` 85,539 crore.

The table below provides a synopsis of the gross loan book of the Corporation:

(` crore)

| As at March 31,

2022 |

As at March 31,

2021 |

|

|---|---|---|

| Individual Loans | 4,31,553 | 3,68,804 |

| Corporate Bodies | 1,30,679 | 1,22,707 |

| Others | 6,131 | 6,787 |

| Total | 5,68,363 | 4,98,298 |

The net increase in the loan book during the year, (after removing the loans that were sold) stood at ` 70,065 crore.

Principal loan repayments stood at ` 99,005 crore compared to ` 92,111 crore in the previous year after excluding loans written off during the year amounting to

` 1,633 crore (Previous Year: ` 1,372 crore).

Prepayments on retail loans stood at 10.3% of the opening balance of individual loans, which was the same as in the previous year. 63% of these prepayments were full prepayments.

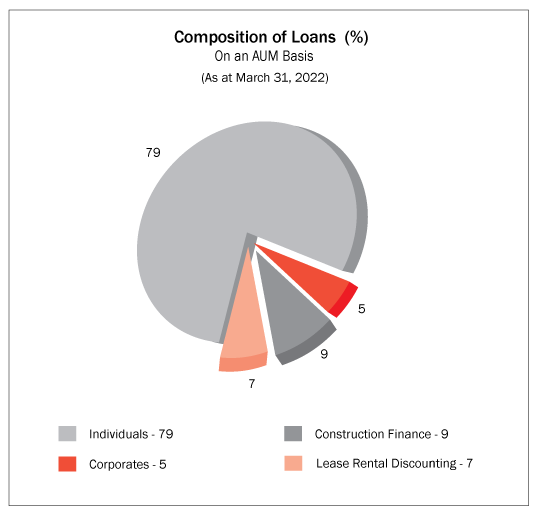

Of the total loan book (including loans sold), individual loans comprise 79%.

The growth in the individual loan book, after adding back loans sold in the preceding twelve months was 25% (17% net of loans sold).

Non-individual loans grew by 6% during the year and comprised 21% of the portfolio.

The growth in the total loan book would have been 20% had the Corporation not sold any loans during the year.

Assignment/Sale of Individual Loans

During the year, the Corporation sold individual loans amounting to ` 28,455 crore (Previous Year: ` 18,980 crore). The loans assigned during the year were primarily to HDFC Bank pursuant to the buyback option embedded in the home loan arrangement between the Corporation and HDFC Bank. Of the total individual loans sold during the year, ` 6,980 crore qualified as priority sector advances for banks.

As at March 31, 2022, individual loans outstanding in respect of all loans assigned/securitised stood at ` 83,880 crore. HDFC continues to service these loans.

During the year, the Corporation also assigned ` 1,500 crore of standard, non-individual loans.

The advantage for the Corporation in selling loans under the loan assignment route is that there is no credit enhancement to be provided by the Corporation on the loans sold and the credit risk is passed on to the purchaser. The assignment of loans is also Return on Equity accretive to the Corporation as no capital or provisioning is required to be maintained on these loans.

Product-wise Loan Performance

As at March 31, 2022, the product-wise break-up of loans on an A8M basis was -- individual loans: 79%, corporate loans: 5%, construction finance: 9% and commercial lease rental discounting: 7%.

During the year, on an AUM basis, 88% of the incremental growth in the loan book came from individual loans and 12% from

non-individual loans.

Sourcing of Loans

The Corporation’s distribution channels which include HDFC Sales Private Limited (HSPL), HDFC Bank and third party direct selling associates (DSAs) play an important role in sourcing home loans.

HDFC has third party distribution tie-ups with commercial banks, small finance banks, non-banking financial companies and other distribution companies including e-portals for retail loans. All distribution channels only source loans, while the control over the credit, legal and technical appraisal continues to rest with HDFC, thereby ensuring that the quality of loans disbursed is not compromised in any way and is consistent across all distribution channels.

During the year, the Corporation entered into a retail home loan referral arrangement with India Post Payment Bank (IPPB). IPPB through its 650 branches and vast network of 1.55 lac post offices will promote housing loans and provide the Corporation with leads of prospective customers. IPPB is of strategic importance for the Corporation given that it has over 4.7 crore customers. This alliance will help the Corporation access tier 3 and tier 4 markets faster and will help facilitate home loans for customers in these geographies.

The Corporation also has retail home loan referral arrangements with other banks who provide leads of prospective home loan customers.

In value terms, HSPL, HDFC Bank and third party DSAs sourced 52%, 28% and 18% of home loans disbursed respectively during the year. 82% of the Corporation’s individual loan business during the year was sourced directly or through the Corporation’s affiliates.

Physical and Digital Reach

Geographic Reach

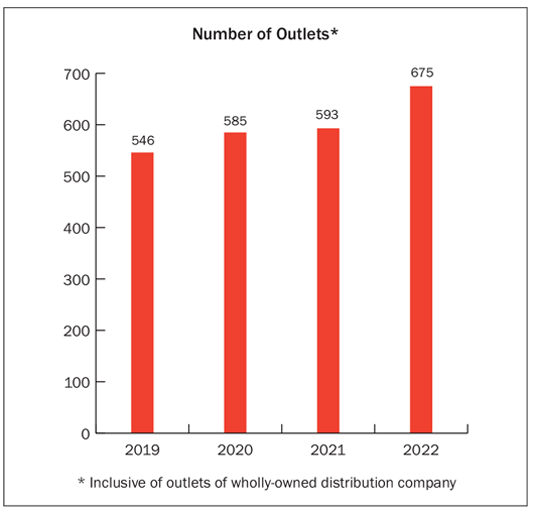

The Corporation’s physical distribution network now spans 675 outlets, which includes 211 offices of HDFC’s wholllyowned distribution company, HSPL. During the year, efforts were focused on expanding into deep geographies so as to widen the Corporation’s footprint. These outlets are typically manned by one or two individuals and leverage completely on the digital platforms of the Corporation.

HDFC has overseas offices in London, Singapore and Dubai. The Dubai office caters to customers across Middle-East through its service associates.

Digitalisation Initiatives

The Corporation’s digitalisation objective is to transform the customer’s journey across the lifecycle to improve the customer’s overall experience. The Corporation has adopted 'DASH’ philosophy -- Digital first, Agile methods, Seamless architecture and HDFC for You, the platform to track outcomes and input metrics.

The Corporation had several digitalisation tools and platforms in place to support the lending business. The digital on-boarding platform used for direct and website based applications is also used by channel partners. The Corporation’s mobile app for channel partners facilitates real time tracking and processing of loan applications.

Direct fetch information from public portals like the Goods and Services Tax Network, Ministry of Corporate Affairs, Income Tax and tools like bank statement information analysers, which provides real-time, analytical capabilities are integrated into the loan processes, thereby strengthening loan origination and processing controls. Several other loan control checks have been automated. The application programming interface (API) has been facilitated through various fintech platforms.

During the year, approximately 91% new loan applications were received through digital channels. The Corporation has also piloted an end-to-end digitally enabled product, wherein all checks and controls are entirely system driven and loans are auto approved.

The Corporation’s ‘One HDFC’ strategy capitalises on using technology seamlessly and facilitates redeployment of manpower, wherever it is most required. Thus, if there is a particular geography where there is an increase in business volumes, the Corporation optimises its use of resources so as to ensure that high customer service standards are maintained. Customers have appreciated the ease of using the Corporation’s digital platforms.

Marketing Initiatives

During the year the Corporation increased its use of marketing technology solutions which enabled customers to seamlessly avail home loans digitally. This also helped the Corporation provide uninterrupted and real-time service to its customers across geographies.

The Corporation used marketing automation technologies to effectively market on multiple digital channels by identifying potential customers and automating the process to bring in efficiency in the sales funnel. The Corporation leveraged various enterprise solutions to understand user behaviour and journeys, optimise customer engagement by delivering personalised experiences, identify customer segments and use them effectively for marketing purposes.

HDFC’s automated chatbot services on its website with livechat and video conferencing facilities provides roundthe-clock customer support and personalised experiences to customers. The Corporation has also deployed the AI Chatbot on popular social media platforms as well to enable its existing and new customers connect and interact with the brand and get immediate, personalised service 24x7. Capitalising on the growing preference towards voice assistance, the Corporation served customers with voice based conversational solutions.

Through exclusive association with developers, the Corporation was able to amplify brand awareness and connect with in-market audiences at the right time, just before their purchase decision.

For users looking for home loan related information online in their regional language, the Corporation had customised advertisements, hyperlocal digital campaigns and content in vernacular languages.

The customer lifecycle management programme helped the Corporation focus on business growth by upselling and cross-selling products to existing customers at predefined milestones, using digital analytics.

Data Analytics

The Corporation uses data science to enhance operational efficiencies, assist business growth and improve risk management practices in the organisation.

During the year, a machine learning (ML) based, artificial intelligence driven credit underwriting engine was developed for individual loans to enable faster credit appraisal decisions and be future ready to manage increased scale efficiently.

A ML lead scoring model helped improve the productivity of the conversion funnel. ML models are also being built to proactively predict the risk of delinquency.

To better serve customers, an advanced ML model was made to automatically classify queries/requests into coherent categories which facilitates a swifter response to customers.

Data analytics also provides insights on market trends, portfolio segments and customer behaviour which in turn helps overall growth in the business.

Investments

The Investment Committee constituted by the Board of Directors is responsible for approving investment proposals in line with the limits as set out by the Board of Directors.

The investment function supports the core business of housing finance. The investment mandate includes ensuring adequate levels of liquidity to support core business requirements, maintaining a high degree of safety and optimising the level of returns, consistent with acceptable levels of risk.

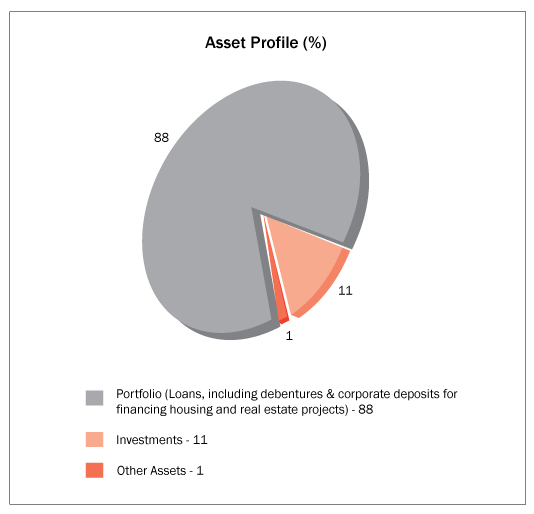

As at March 31, 2022, the investment portfolio stood at ` 68,592 crore compared to

` 68,637 crore in the previous year. The proportion of investments to total assets was 11%.

NBFC-HFCs are required to maintain a statutory liquidity ratio (SLR) in respect of public deposits raised. As at March 31, 2022, the SLR requirement was 13% of public deposits.

The Corporation has investments in High Quality Liquid Assets (HQLA) in order to meet SLR and LCR requirements.

As at March 31, 2022, the total government securities stood at ` 36,906 crore of which ` 14,982 crore was towards SLR and ` 21,924 crore comprised securities held towards liquidity support.

Surplus from deployment in liquid instruments was ` 561 crore.

The average yield on the non-equity treasury portfolio for the year was 5.9% per annum on an annualised basis.

Dividend received during the year was ` 1,511 crore, of which ` 1,480 crore was received from subsidiary and associate companies.

During the year, the profit on sale of investments stood at ` 263 crore. This pertained to the entire stake sale of Good Host Spaces Private Limited of ` 54 crore and part stake sale in HDFC ERGO General Insurance Company Limited (HDFC ERGO) of ` 209 crore. RBI had mandated that the Corporation reduce its equity shareholding to below 50% in HDFC ERGO by May 12, 2021. In the previous year, the profit on sale of investments stood at ` 1,398 crore and pertained to the stake sale in HDFC Life Insurance Company Limited (HDFC Life).

As at March 31, 2022, the market value of listed equity investments in subsidiary and associate companies was higher by ` 2,34,248 crore compared to the value at which these investments are reflected in the balance sheet. This unaccounted gain includes appreciation in the market value of investments in HDFC Bank held by the Corporation’s wholly-owned subsidiaries, HDFC Investments Limited and HDFC Holdings Limited. It, however, excludes the unrealised gains on unlisted subsidiaries.

Asset Quality

Non-Performing Assets & Provisioning

During periods of rising infections, collections tended to get impacted as recovery teams were unable to do field visits, but as infections waned, collection efficiency ratios for loans improved significantly. The average collection efficiency for individual loans on a cumulative basis during the quarter ended March 2022 was over 99%.

On November 12, 2021, RBI issued a notification to lending institutions on harmonisation of Prudential Norms on Income Recognition, Asset Classification & Provisioning (IRACP norms). Subsequently, RBI deferred the effective date to September 30, 2022. The Corporation has continued to report non-performing loans (NPLs) in accordance with the November 12, 2021 circular.

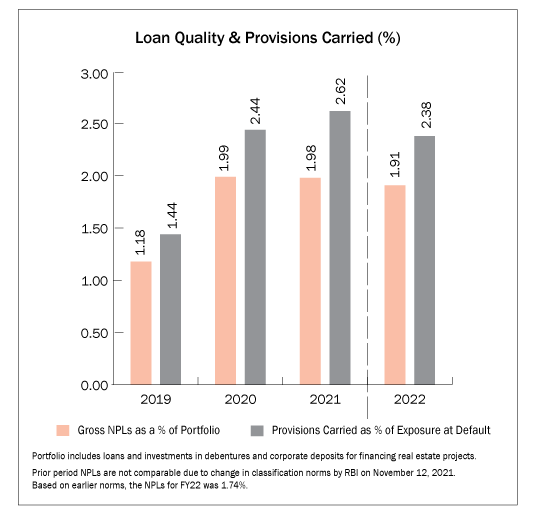

As at March 31, 2022, the gross individual NPLs stood at 0.99% of the individual portfolio, and the gross nonperforming non-individual loans stood at 4.76% of the non-individual portfolio. The gross NPLs as at March 31, 2022 stood at ` 10,741 crore. This is equivalent to 1.91% of the portfolio.

This marked a significant improvement compared to the position as at December 31, 2021, where the gross individual NPLs stood at 1.44% and the gross nonindividual NPLs stood at 5.04% of the non-individual portfolio. Total NPLs as at December 31, 2021 stood at 2.32% of the portfolio as against 1.91% as at March 31, 2022.

This marked a significant improvement compared to the position as at December 31, 2021, where the gross individual NPLs stood at 1.44% and the gross nonindividual NPLs stood at 5.04% of the non-individual portfolio. Total NPLs as at December 31, 2021 stood at 2.32% of the portfolio as against 1.91% as at March 31, 2022.

Based on the earlier NPL norms and to provide a like-for-like comparison with the previous year, the gross individual NPLs at March 31, 2022 was 0.78% (PY: 0.99%) of the individual portfolio and total NPLs was 1.74% (PY: 1.98%) of the loan portfolio. This reflected improvement in the overall asset quality.

To reiterate, the Corporation did not opt for the deferment, but declared its NPAs and made provisioning based on the November 12, 2021 notification of RBI.

As at March 31, 2022, the Corporation carried a total provision of ` 13,506 crore. The provisions carried as a percentage of the Exposure at Default (EAD) is equivalent to 2.38%.

On a gross basis, the Corporation has written off loans aggregating ` 1,633 crore during the year. On loans that have been written off, the Corporation will continue making efforts to recover the money. The Corporation has, since inception, written off loans (net of subsequent recovery) aggregating to ` 4,999 crore. Thus, as at March 31, 2022, the total loan write offs stood at 28 basis points of cumulative disbursements since inception of the Corporation.

In accordance with the write off policy of the Corporation, loans may entail either a partial or a full write off, determined on a case-by-case basis.

During the year, where recovery has proven to be difficult, the Corporation continued to adopt various methods to settle loans. The Corporation has also opted to reach settlements through sell-downs to asset reconstruction companies, institutions or private equity players. In certain overdue loans, the Corporation has resorted to the invocation of pledged shares.

The Corporation has in select cases, entered into debt asset swap arrangements entailing immovable property. Whilst entering into such arrangements, the Corporation’s key considerations are the marketability and saleability of the property, its present and expected valuation, demand and supply factors based on the location of the property, legal titles, whether it is free from encumbrances, amongst other factors. The properties taken over by the Corporation are a mix of residential and commercial properties located in key metro cities. The properties are either for the Corporation’s own use or being held for capital appreciation, which the Corporation will dispose of at an appropriate time and in accordance with directions as stipulated by the regulator.

Accordingly, the Corporation has entered into debt asset swaps wherein the carrying amount of the financial and non-financial assets taken over as at March 31, 2022 stood at ` 306 crore and ` 3,834 crore respectively.

Impairment on Financial Instruments-Expected Credit Loss

Under Ind AS, asset classification and provisioning moves from the 'rule based’, incurred loss model to the Expected Credit Loss (ECL) model of providing for expected future credit losses. Thus, loan loss provisions are made on the basis of the Corporation’s historical loss experience and future expected credit loss, after factoring in various other parameters.

Classification of Assets

| Exposure at Default (EAD) |

As at March 31,

2022 |

As at March 31,

2021 |

|---|---|---|

| Stage 1 | 93.3% | 91.4% |

| Stage 2 | 4.4% | 6.3% |

| Stage 3 | 2.3% | 2.3% |

| Total | 100.0% | 100.0% |

As a matter of prudence, the Corporation had classified certain accounts from Stage 1 to Stage 2 if the customer had opted for either ECLGS or OTR.

As at March 31, 2022, the Corporation saw a reduction in Stage 2 and 3 assets to 6.7% of EAD as compared to 8.6% in the previous year. This is reflective of an overall improvement in collection efficiency as well as stabilisation of credit costs on a marginal basis.

The Corporation’s Expected Credit Loss (ECL) charged to the Statement of Profit and Loss for the year ended March 31, 2022 was lower at ` 1,932 crore compared to

` 2,948 crore in the previous year.

Credit costs for the year ended March 31, 2022 was 33 basis points compared to 56 basis points in the previous year.

Expected Credit Loss Based on Exposure at Default

(` crore)

| EAD | Individual | Non-Individual | Total | |||

|---|---|---|---|---|---|---|

| Stage 1 | 4,18,848 | 97.2% | 1,10,959 | 81.1% | 5,29,807 | 93.3% |

| Stage 2 | 7,381 | 1.7% | 17,871 | 13.1% | 25,252 | 4.4% |

| Stage 3 | 4,940 | 1.1% | 7,928 | 5.8% | 12,868 | 2.3% |

| EAD Total | 4,31,169 | 100.0% | 1,36,758 | 100.0% | 5,67,927 | 100.0% |

| ECL | Individual | Non-Individual | Total | |||

|---|---|---|---|---|---|---|

| Stage 1 | 836 | 27.6% | 539 | 5.1% | 1,375 | 10.1% |

| Stage 2 | 1,110 | 36.6% | 4,030 | 38.5% | 5,140 | 38.1% |

| Stage 3 | 1,084 | 35.8% | 5,907 | 56.4% | 6,991 | 51.8% |

| ECL Total | 3,030 | 100.0% | 10,476 | 100.0% | 13,506 | 100.0% |

| ECL / EAD | Individual | Non-Individual | Total |

|---|---|---|---|

| Stage 1 | 0.2% | 0.5% | 0.3% |

| Stage 2 | 15% | 23% | 20% |

| Stage 3 | 22% | 75% | 54% |

| ECL / EAD | 0.70% | 7.66% | 2.38% |

The total balance in the Impairment on Financial Instruments – Expected Credit Loss (provisions carried) as at March 31, 2022 amounted to ` 13,506 crore. This is equivalent to 2.38% of the EAD. The balance in the Impairment on Financial Instruments – Expected Credit Loss more than adequately covers loans where the instalments were in arrears.

Fixed Assets and Investment Properties

Net Property, Plant and Equipment as at March 31, 2022 amounted to ` 1,074 crore. Net additions to Property, Plant and Equipment during the year was

` 241 crore, including right-of-use assets of ` 163 crore.

Net investment in properties as at March 31, 2022 amounted to ` 2,686 crore. Net additions to investment properties during the year was ` 1,835 crore (including advance for under construction properties).

Resource Mobilisation

Share Capital

As on April 1, 2021, the Corporation had a balance of ` 361 crore in the share capital account. The Corporation has allotted 90,81,843 equity shares of face value of

` 2 each pursuant to the exercise of stock options by certain employees/directors. After considering the above allotments during the year, the balance in the share capital account as on March 31, 2022 was ` 363 crore.

Warrants

In August 2020, the Corporation had completed its Qualified Institutional Placement of equity shares and secured, redeemable non-convertible debentures simultaneously with warrants.

The Corporation had raised ` 307 crore through the issue and allotment of 1,70,57,400 warrants at an issue price of ` 180 per warrant which was paid up front. The warrants carry a right exercisable by the warrant holder to exchange each warrant for one equity share of face value of ` 2 each of the Corporation at any time on or before August 10, 2023, at a warrant exercise price of ` 2,165 per equity share, to be paid by the warrant holder at the time of exchange of the warrants. As at March 31, 2022, no warrants had been converted into equity shares.

The equity shares, warrants and NCDs are listed on BSE Limited (BSE) and National Stock Exchange of India Limited (NSE).

Subordinated Debt

As at March 31, 2022, the Corporation’s outstanding subordinated debt stood at ` 3,000 crore. The debt is subordinated to present and future senior indebtedness of the Corporation and has been assigned the highest rating of 'RISIL AAA/Stable' and 'ICRA AAA/Stable'. The Corporation did not issue any subordinated debt during the year.

Based on the balance term to maturity, as at March 31, 2022, ` 1,200 crore of the book value of subordinated debt was considered as Tier II under the regulatory guidelines for the purpose of capital adequacy computation.

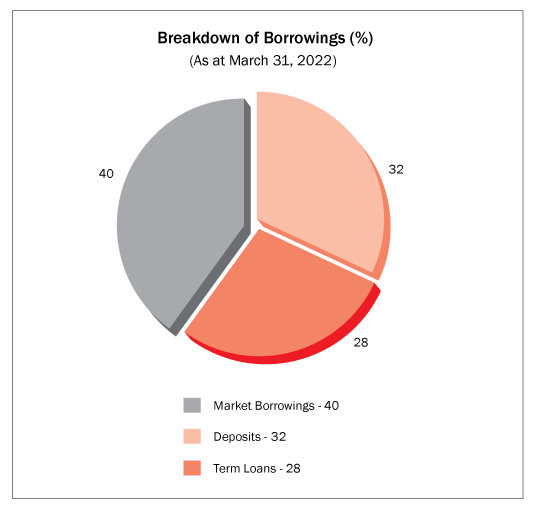

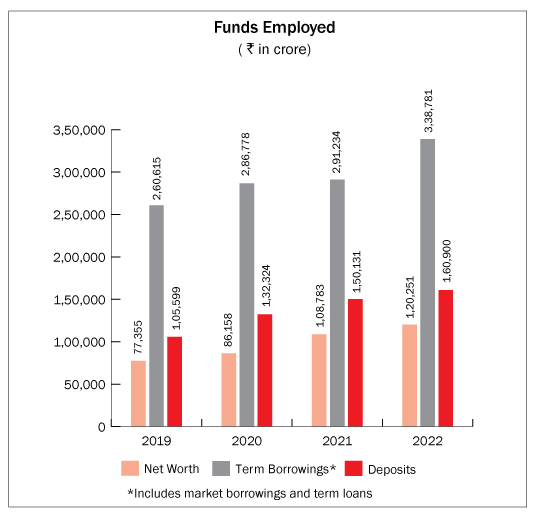

Borrowings

Borrowings as at March 31, 2022 amounted to ` 4,99,681 crore as against ` 4,41,365 crore in the previous year. Borrowings constituted 78% of funds employed as at March 31, 2022. Of the total borrowings, debentures and securities constituted 40%, deposits 32% and term loans 28%.

Summary of Total Borrowings

(` crore)

| Borrowings |

March 31,

2022 |

March 31,

2021 |

|---|---|---|

| Term Loans | 1,39,851 | 1,05,179 |

| Market Borrowings | 1,98,930 | 1,86,055 |

| Deposits | 1,60,900 | 1,50,131 |

| Total | 4,99,681 | 4,41,365 |

Non-Convertible Debentures & Commercial Paper

During the year under review, the Corporation raised an amount of ` 50,247 crore through secured, redeemable non-convertible debentures (NCDs), issued in various tranches on a private placement basis. Of the NCDs raised during the year, 55% were of original tenors of over 10 years.

The Corporation’s NCDs have been listed on the wholesale debt market segment of the NSE and the BSE. The NCDs have been assigned the highest ratings of 'CRISIL AAA/Stable' and 'ICRA AAA/Stable'. The Corporation has been regular in making payments of principal and interest on the NCDs.

The funds raised from the issuance of NCDs were utilised for housing finance business requirements. Details of all the above-mentioned issues and the end use of funds were provided to the Audit and Governance Committee on a periodic basis.

There are no NCDs which have not been claimed by investors or not paid by the Corporation after the date on which the NCDs became due for redemption.

The Corporation has been qualified as a 'large corporate' by SEBI and accordingly has ensured that more than 25% of its incremental borrowings during the year was by way of issuance of debt securities.

The Corporation’s short-term debt programme has been assigned the highest ratings of 'CRISIL A1+', 'ICRA A1+' and 'CARE A1+' by CRISIL, ICRA and CARE Ratings respectively.

As at March 31, 2022, the Corporation had commercial paper (CPs) with an outstanding amount of ` 30,238 crore and the weighted average outstanding maturity was 229 days. CPs constituted 6% of the outstanding borrowing as at March 31, 2022. The CPs of the Corporation are listed on the wholesale debt market segments of the NSE and BSE.

Rupee Denominated Bonds Overseas

Under the Corporation’s Medium Term Note Programme, the Corporation did not raise any funds through Rupee denominated bonds during the year. As at March 31, 2022, total outstanding Rupee denominated bonds overseas stood at ` 1,797 crore.

Deposits

According to regulatory directions, housing finance companies can accept public deposits not exceeding 3 times its net owned funds.

As at March 31, 2022, total outstanding deposits stood at ` 1,60,900 crore compared to ` 1,50,131 crore in the previous year. The number of deposit accounts stood at over 19.9 lac.

CRISIL and ICRA have for the twenty-seventh consecutive year, reaffirmed their 'FAAA/Stable' and 'MAAA/Stable' ratings respectively for HDFC’s deposits. These ratings represent the highest degree of safety regarding timely servicing of financial obligations and also carries the lowest credit risk.

The Corporation continued with its strong mobilisation of deposits during the financial year. The renewal ratio of retail deposits stood at 61% during the year.

The Corporation has 24,214 active key deposit agents. Brokerage is paid on the deposits generated by deposits agents, depending on the product, amount and period of the deposit. Incentive is also paid on certain products, depending on the amount of deposits generated by the deposit agent. Brokerage and incentive payments are amortised over the period of the deposit.

The Corporation’s online deposit platform continued to be well received and appreciated for its simplicity and convenience, besides being a green initiative. During the year, 66% of transactions were on-boarded through the online deposits platform. The Corporation continued its training of key partners to effectively use the online deposit platform continued.

During the year, the Corporation launched Green and Sustainable deposits for retail depositors, wherein the funds would be used towards green housing and other sustainability initiatives.

Term Loans from Banks Institutions and Refinance from National Housing Bank (NHB)

As at March 31, 2022, the total loans outstanding from banks, institutions and NHB (including foreign currency borrowings from domestic banks) amounted to ` 1,39,851 crore as compared to ` 1,05,179 crore as at March 31, 2021.

HDFC’s long-term and short-term bank loan facilities have been assigned the highest rating by CARE and ICRA, signifying highest safety for timely servicing of debt obligations.

During the year, the Corporation availed refinance from NHB under various refinance schemes such as Special Refinance Facility, Regular Refinance Scheme and Promoting Green Housing Refinance Scheme amounting to ` 3,425 crore.

External Commercial Borrowings

The Corporation has in place a medium term note programme for an amount of up to USD 2.8 billion which enables the Corporation to issue rupee/ foreign currency denominated bonds in the international capital markets, subject to regulatory approvals.

During the year, the Corporation has raised External Commercial Borrowings USD 250 million from International Finance Corporation and USD 200 million from Asia Infrastructure Investment Bank, with mandates to on-lend for affordable and green housing.

The outstanding foreign currency borrowings constitute borrowings from Asian Development Bank under the Housing Finance Facility ProMect (USD 4 million), and External Commercial Borrowing towards Low Cost Affordable Housing (USD 1,837 million).

Risk Management

The Corporation has a risk management framework with overall governance and oversight from the Risk Management Committee, the Audit and Governance Committee and the board of directors. The Corporation recognises that risk management entails a combination of both, a bottom-up and a larger strategic overview of all functions across the organisation. Some of the risk scenarios identified during the year are:

Credit Risk: The Corporation has several workflow integrated controls at different stages of the credit appraisal lifecycle to identify and evaluate credit risks on its individual and non-individual portfolios. This is supported on an ongoing basis by analytical industry based studies, credit deviation analysis, specific credit portfolio studies and periodic assessment via risk registers on various external and internal risks on asset quality, recovery and credit loss.

Market, Liquidity and Interest Rate Risk: The Corporation has a board approved ALM framework with an ALCO driven approach to periodically evaluate various market, liquidity and interest rate risks and various macro-economic events impacting the same. A periodic assessment via risk registers, including risks of market driven uncertainty and regulatory requirements are also assessed on a predefined scoring mechanism to review risk levels from time to time.

Operational Risk: Various levels of control review by internal and independent teams are undertaken and escalated at appropriate levels, on a periodic basis. These are backed by independent studies on documentation maintenance, adherence to processes and risk register based granular risk event assessment on gaps in people, process and systems.

Pandemic Driven Risks: The Corporation responded to the pandemic with improving its operational flexibility and strengthening its digital outreach, while complying with various legal, regulatory and statutory requirements. It continued to monitor closely its asset quality through tracking project delays, economic downturn, high risk customers, amongst others.

Cyber Security Risks: The Corporation has a welldeveloped Information Security and Cyber Security policy framework. There is a robust mechanism for Securities Operations Centre (SOC) driven alerts and incident management. Initiatives on monitoring and assessment services, end-point protection controls, SOC 24X7, vulnerability assessment and penetration testing, data leakage prevention strategies and mobile application management form important elements of the cyber security strategy of the Corporation.

Climate and ESG Risks: An ESG framework, including ESG focused portfolio products, tracking of various sustainability parameters, monitoring ESG metrics and initiatives form part of the strategy to manage climate and ESG risks.

Reputation Risk: Centralised monitoring of various categories of customer grievances, social media and public media representation, along with a periodic risk profile evaluation with risks impacting the reputation of the Corporation form part of the reputation risk management strategy.

Financial Risk Management

The Corporation manages its liquidity, foreign exchange, interest rate and counterparty risks in accordance with its Financial Risk Management and Asset Liability Management Policy and prescribed guidelines.

The Corporation maintains minimum daily liquidity equivalent of at least one month’s market maturities, in the form of units of mutual funds and investment in government securities. Further, under the RBI’s guidelines on Liquidity Risk Management Framework, the Corporation is required to maintain HQLA covering at least the next 30 days of net cash outflows (as defined in the guidelines) with effect from December 1, 2021.

Assets and liabilities in foreign currencies are converted at the rates of exchange prevailing at the year-end. Foreign currency liabilities aggregated to USD 1,841 million as at March 31, 2022. The currency risk on the borrowings is hedged through derivatives such as swaps and options entered into with banks/financial institutions. As at March 31, 2022, the Corporation’s foreign currency exposure on borrowings net of risk management arrangements was nil.

HDFC’s foreign currency borrowings are linked to USD LIBOR or Tokyo Overnight Average Rate (TONA), the risk on which is hedged through coupon only and foreign currency interest rate swaps. The unhedged exposure on the foreign currency coupon for maturities beyond one year is nil on USD and JPY 234 million.

The Corporation enters into INR interest rate swaps to manage the risk arising from the mismatch on account of floating rate loans forming bulk of the assets, and fixed rate borrowings forming a large portion of liabilities. As at March 31, 2022, HDFC has entered into such swaps for converting its fixed rate rupee liabilities of a notional amount of ` 1,44,845 crore for varying maturities into floating rate liabilities linked to Overnight Index Swaps and yields on government securities. As a result of the swaps, HDFC pays the floating rate and receives the fixed rate.

As at March 31, 2022, 85% of the total assets and 84% of the total liabilities were on a floating rate basis.

The Corporation has an ongoing exercise to hedge potential credit risks on receivables from banks on account of derivative contracts, by entering into collateralisation arrangements with them.

The Corporation does not have any exposures to commodities and hence does not have any commodity price risk.

Asset Liability Management (ALM)

Assets and liabilities are classified on the basis of their contracted maturities. However, the estimates based on past trends in respect of prepayment of loans and renewal of liabilities which are in accordance with the ALM guidelines issued by the regulator have not been taken into consideration while classifying the assets and liabilities under the Schedule III to the Companies Act, 2013.

The ALM position of the Corporation is based on the maturity buckets as per the regulatory guidelines. In computing the information, certain estimates, assumptions and adjustments have been made by the management. The ALM position is as under:

As at March 31, 2022, assets and liabilities with maturity up to 1 year amounted to ` 1,42,355 crore and ` 1,15,107 crore respectively. Assets and liabilities with maturity of greater than 1 year and up to 5 years amounted to ` 2,87,868 crore and ` 2,54,530 crore respectively and assets and liabilities with maturity beyond 5 years amounted to ` 2,10,640 crore and ` 2,71,226 crore respectively.

Capital Adequacy Ratio

The Corporation’s capital adequacy ratio (CAR) stood at 22.8%, of which Tier I capital was 22.2% and Tier II capital was 0.6%. The minimum CAR as per the prescribed regulations is 15% and minimum Tier 1 Capital is 10%.

As at March 31, 2022, the risk weighted assets stood at approximately ` 4,40,300 crore.

Internal Control Systems and their Adequacy

The Corporation has instituted adequate internal control systems commensurate with the nature of its business and the size of its operations. Internal audit is carried out by independent firms of chartered accountants and cover all the branches and key areas of business. All significant audit observations and follow-up actions thereon are reported to the Audit and Governance Committee. All the members of the Audit and Governance Committee are independent directors.

Human Resources

The Corporation has always believed that its employees are its most valued resource and has always ensured their all-round development. The employees are trained in functional and behavioural skills to ensure high standards of service to internal and external stakeholders.

During the year, the Corporation continued to leverage on technology and developed various online courses to ensure continuity of knowledge and skill based training. Online courses were developed and assigned to all employees on the online e-learning platform - HDFC Aspire. In-house videos on various products and processes were developed by employees to share best practices. Further, the Corporation procured a number of soft skills e-learning courses for its employees.

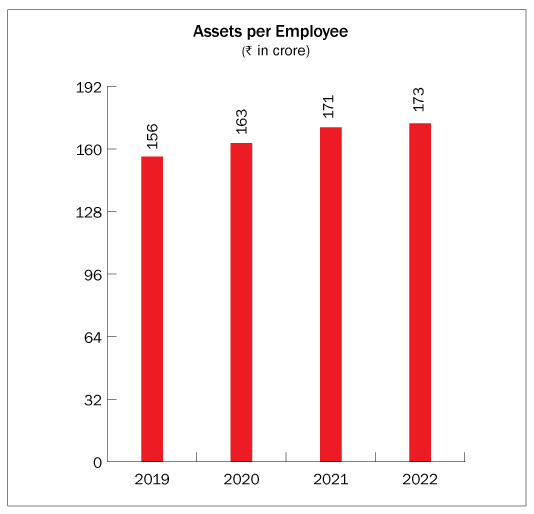

As at March 31, 2022, the Corporation has 464 offices (excluding offices of HSPL) and the total number of employees is 3,599.

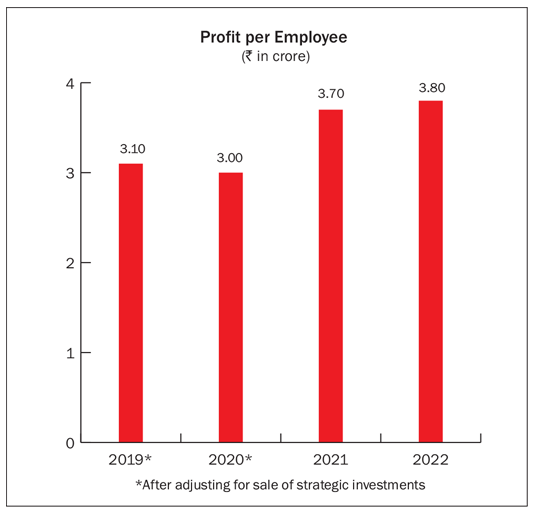

Total assets per employee as at March 31, 2022 stood at ` 173 crore as compared to ` 171 crore in the previous year. The net profit per employee as at March 31, 2022 was ` 3.8 crore compared to ` 3.7 crore in the previous year.

Awards and Recognitions

During the year, some of the awards and recognitions received by the Corporation included:

Subsidiaries and Associates

Though housing finance remains the core business, the Corporation has created tremendous value through its investments in its subsidiary and associate companies.

As stipulated by the regulator, the Corporation’s shareholding in both its insurance companies, HDFC Life and HDFC ERGO is below 50%. For the purpose of consolidated financial statements, both entities continue to be accounted as subsidiary companies. As per IndAS, the Corporation consolidates a company when it controls the company.

The financials with respect to HDFC Bank, HDFC Life and HDFC ER*O are presented as per their statutory financial statements prepared under Indian GAAP.

Review of Key Subsidiary and Associate Companies

HDFC Bank Limited (HDFC Bank)

During the year, the Corporation and HDFC Bank continued to maintain an arm’s length relationship in accordance with the regulatory framework. Both organisations, however, capitalised on the strong synergies through a system of referrals, special arrangements and cross selling in order to effectively provide a wide range of products and services under the 'HDFC’ brand name.

As at March 31, 2022, advances of HDFC Bank stood at ` 13,68,821 crore – an increase of 21% over the previous year. Total deposits stood at ` 15,59,217 crore – an increase of 17%. As at March 31, 2022, HDFC Bank’s distribution network includes 6,342 banking outlets and 18,130 ATMs in 3,188 locations.

For the year ended March 31, 2022, HDFC Bank reported a profit after tax of ` 36,961 crore as against ` 31,117 crore in the previous year, representing an increase of 19%. HDFC Bank declared a dividend of ` 15.5 per share of face value of ` 1 each for the year ended March 31, 2022.

HDFC together with its whollly-owned subsidiaries, HDFC Investments Limited and HDFC Holdings Limited holds 21% of the equity share capital of HDFC Bank.

During the year, the Corporation received dividend of ` 757 crore from HDFC Bank (includes ` 195 crore received by HDFC Investments Limited and HDFC Holdings Limited.)

HDFC Life Insurance Company Limited (HDFC Life)

For the year ended March 31, 2022, total premium income of HDFC Life stood at ` 45,963 crore as compared to ` 38,583 crore in the previous year, representing a growth of 19%.

The company recorded a growth of 16% in terms of individual weighted received premium (WRP) during FY22, with a market share of 14.8% and 9.3% in the private and overall sector respectively. The new business margin for FY22 stood at 27.4% compared to 26.1% for FY21.

The company covered 54 million lives in FY22, registering an increase of 36% over FY21. The renewal premiums grew by 18% during the year. The 13-month and 61-month persistency (including single premium) improved during the year to 92% and 58% respectively, as against 90% and 53% in FY21.

As at March 31, 2022, the Indian Embedded Value stood at ` 30,048 crore compared to ` 26,617 crore in the previous year. The operating return on embedded value stood at 19.0% before excess mortality reserve (EMR) charge and 16.6% post EMR.

The solvency ratio of the company was 176% as at March 31, 2022 as against the minimum regulatory requirement of 150%.

HDFC Life reported a standalone profit after tax of ` 1,208 crore for the year ended March 31, 2022 – a decline of 11% over the previous year due to higher mortality reserve created during the year. Post the second wave of CO9ID-19, the profit after tax in the third and fourth quarter of FY22 improved steadily, with fourth quarter registering a growth of 12% over the corresponding quarter of the previous year.

During the year HDFC Life acquired a 100% stake in Exide Life Insurance Company Limited (Exide Life) from Exide Industries Limited via issuance of 8,70,22,222 shares at an issue price of ` 685 per share and a cash pay-out of ` 726 crore, aggregating to

` 6,687 crore. Consequently, Exide Life became a wholly-owned subsidiary of HDFC Life. The merger process has been initiated with NCLT and is expected to be completed in FY23.

During the year, Exide Life recorded a growth of 22% based on individual WRP and its embedded value as at March 31, 2022 was

` 2,910 crore.

HDFC Life recommended a dividend of ` 1.70 per equity share of face value of ` 10 each for FY22.

During the year, the Corporation received ` 204 crore as dividend from HDFC Life.

The Corporation’s shareholding in HDFC Life and Exide Life both, stood at 47.81%.

HDFC Asset Management Company Limited (HDFC AMC)

HDFC AMC is one of India’s largest mutual fund managers. As at March 31, 2022, the quarterly average assets under management (QAAUM) stood at ` 4.3 lac crore.

The ratio of equity-oriented AUM and non-equity oriented A8M was 51:49. HDFC AMC is amongst the largest actively managed equity-oriented mutual funds in the country, with a market share at 11.5% in terms of actively managed equity-oriented QAAUM as at March 31, 2022.

For the year ended March 31, 2022, the profit after tax stood at ` 1,393 crore as against ` 1,326 crore in the previous year.

HDFC AMC recommended a final dividend of ` 42 per equity share of ` 5 each for FY22.

During the year, the Corporation received dividend of ` 381 crore from HDFC AMC.

HDFC holds 52.6% of the equity share capital of HDFC AMC.

HDFC ERGO General Insurance Company Limited (HDFC ERGO)

HDFC ERGO continued to retain its market ranking as the third largest private sector player in the general insurance industry. The company had a market share of 10.3% (private sector) and 6.1% (overall) in terms of gross direct premium for the year ended March 31, 2022.

The company offers a complete range of insurance products like motor, health, travel, home and personal accident in the retail segment, customised products like property, marine, aviation and liability insurance in the corporate segment and crop insurance. The company had a balanced portfolio mix with the retail segment accounting for 61% of the business.

The gross written premium of HDFC ERGO for the year ended March 31, 2022 stood at ` 13,707 crore compared to ` 12,444 crore in the previous year.

The combined ratio as at March 31, 2022 stood at 107.5%. The solvency ratio of the company was 164% as at March 31, 2022 as against the minimum regulatory requirement of 150%.

For the year ended March 31, 2022, the reported profit after tax stood at ` 500 crore compared to ` 592 crore in the previous year. Profits were impacted due to higher CO9ID-19 losses. The profit after tax before considering the COVID-19 impact was ` 1,093 crore as compared to ` 833 crore in the previous year.

HDFC ERGO paid an interim dividend of ` 3.25 per equity share of face value ` 10 per share during the year. Accordingly, the Corporation received ` 116 crore as dividend from HDFC ERGO.

HDFC holds 49.98% of the equity share capital of HDFC ERGO.

HDFC Property Funds

HDFC Venture Capital Limited & HDFC Property Ventures Limited

HDFC Venture Capital Limited (HVCL) is the investment manager to HDFC Property Fund, a venture capital fund registered with SEBI. All the investments of the closeended fund have been fully exited in FY21. The entire units held by the contributors have also been redeemed. HDFC Property Fund is no longer undertaking activities as a venture capital fund and the same has been intimated to SEBI.

HDFC Property Ventures Limited (HPVL) provides investment advisory services to domestic trusts and overseas asset management companies (AMCs). Such AMCs in turn manage and advise offshore private equity funds that invest in the construction and development sector in India.

HDFC holds 80.5% of the equity share capital of HVCL (with the balance held by State Bank of India) and 100% of the equity share capital of HPVL.

HDFC Ventures Trustee Company Limited (HVTCL) is a trustee of HDFC Property Fund, HDFC Investment Trust, HDFC Investment Trust II and HDFC India Real Estate Fund III.

HDFC Capital Advisors Limited (HDFC Capital)

HDFC Capital is in the business of providing investment management services for real estate private equity financing. Set up in 2015, HDFC Capital is aligned with the Government of India’s goal to increase housing supply and support the 'Housing for All’ initiative. The company also seeks to promote innovation and adoption of new technologies within the real estate sector by investing in and partnering with technology companies.

HDFC Capital is one of the largest residential real estate fund managers in India with funds under management of approximately USD 3 billion. The company is the investment manager to HDFC Capital Affordable Real Estate Fund 1 (H-CARE 1), HDFC Capital Affordable Real Estate Fund 2 (H-CARE 2) and HDFC Capital Affordable Real Estate Fund 3 (H-CARE 3), which are registered with SEBI as Category II Alternative Investment Funds.

HDFC Capital provides long-term equity and mezzanine capital to developers at the land and pre-approval stage for the development of affordable and mid-income housing in India. These funds are committed with leading developers across India in the affordable and mid-income housing space. The funds managed by HDFC Capital have recently been rated as one of the world’s largest private finance platforms focused on development of affordable housing.

HDFC Capital believes that new technologies will play a vital role in the creation of efficiencies within the real estate development cycle, which is critical for affordable housing projects. The company has set up the HDFC Affordable Real Estate and Technology Programme (H#ART), a first-of-its-kind initiative aimed at creating efficiencies and lowering costs in each part of the development cycle for a real estate project. HDFC Capital also invests in technology companies such as construction-tech, fin-tech, clean-tech amongst others which are engaged in the affordable housing ecosystem.

In April 2022, HDFC entered into binding agreements to sell 10% of the fully diluted paid-up share capital of HDFC Capital to a wholly-owned subsidiary of Abu Dhabi Investment Authority (ADIA) for ` 184 crore. ADIA is also the primary investor in the alternative investment funds managed by HDFC Capital.

HDFC Sales Private Limited (HSPL)

HSPL continues to strengthen the Corporation’s marketing and sales efforts by providing a dedicated sales force to sell home loans and other financial products, including public deposits. HSPL is also an agent of HDFC Life, HDFC Ergo and HDFC Credila.

HSPL has a presence in 211 locations. During the year under review, HSPL sourced loans accounting for 52% of individual loans disbursed by HDFC.

During the year, the company made a profit of ` 79 crore compared to ` 19 crore in the previous year.

The company made its maiden dividend of ` 2.75 per equity share of face value of ` 10 each, which included an interim dividend of ` 0.70 per equity share.

During the year, the Corporation received dividend of ` 8.5 crore.

HSPL is a whollly-owned subsidiary of the Corporation.

HDFC Credila Financial Services Limited (HDFC Credila)

HDFC Credila is India’s first dedicated education loan company, providing loans to students pursuing higher education in India and abroad. As at March 31, 2022, HDFC Credila had cumulatively disbursed ` 16,364 crore to over 91,000 customers. The outstanding loan book stood at ` 8,838 crore. The average loan amount approved during the year was ` 28.7 lac.

For the year ended March 31, 2022, HDFC Credila reported a profit after tax of ` 206 crore as against ` 155 crore in the previous year, representing a growth of 33%.

As at March 31, 2022, the capital adequacy ratio stood at 18.9% and Tier I capital stood at 14.9%.

HDFC Credila has declared dividend of ` 1 per equity share of face value ` 10 per share during the year.

HDFC Credila is a whollly-owned subsidiary of the Corporation.

HDFC Education and Development Services Private Limited (HDFC Edu)

HDFC Edu is the Corporation’s whollly-owned subsidiary which focuses on the education sector.

The objective of HDFC Edu entering the education space is to imbibe best practices in education and facilitate innovation, thereby creating a visible impact on the education system in the country. HDFC Edu provides various services to the schools -- towards admissions, website development, creating awareness in the community, technology and design consultancy, vendor management, academic content, trainings and other support services required for the smooth functioning of the institutions.

The company provides services to The HDFC Schools which are located in Gurugram, Pune and Bengaluru. These schools are affiliated with the Central Board of Secondary Education. They are also certified as Microsoft Showcase schools and two of them have received The International School Award (ISA), now called International Dimension in Schools (IDS), awarded by the British Council. IDS recognises a school’s commitment to embed international awareness and global citi]enship within the class and school.

The HDFC Schools believe in inclusive education and can cater to children with special needs. The schools also have children from underprivileged backgrounds. The schools now have more than 3,000 students.

AUDITED CONSOLIDATED ACCOUNTS

Whilst Ind AS has been made applicable for NBFCs, including housing finance companies from the accounting period beginning April 1, 2018, the same is still pending for adoption by banks and insurance companies.

The consolidated financial statements comprise the standalone financial statements of the Corporation together with its subsidiaries which are consolidated on a line-by-line basis and its associates which are accounted on the equity method.

On a consolidated basis for the year ended March 31, 2022, the profit before tax was ` 28,252 crore as compared to ` 24,237 crore in the previous year.

After providing ` 4,210 crore (Previous year : ` 3,750 crore) for tax, the profit after tax stood at ` 24,042 crore as compared to

` 20,487 crore in the previous year.

The total comprehensive income stood at ` 23,311 crore as compared to ` 22,069 crore in the previous year.

The profit attributable to the Corporation during the year ended March 31, 2022 was ` 22,595 crore compared to was ` 18,740 crore, representing a growth of 21%.

The post-tax return on assets for the consolidated group accounts for the year ended March 31, 2022 was 2.7%. The return on equity stood at 13.4%. The basic and diluted earnings per share (on a face value of ` 2 per share) for the group was

` 124.9 and ` 123.6 respectively.